In recent years, the financial technology has become a powerful ally for those seeking practical and affordable solutions in their daily lives. One of the most common challenges faced by many people is paying bills in situations of financial hardship. Fortunately, there are several free apps for paying bills in installments which allow you to divide these debts into smaller installments, facilitating financial organization and reducing the impact on the budget.

Additionally, these applications offer services such as debt renegotiation, online credit and even integration with digital banks. With just a few clicks, you can transform a one-off bill into an affordable payment plan, helping you keep your finances under control. Below, we will present five options that stand out in the market and can be real solutions to your financial problems.

Why use apps to pay bills in installments?

Before we explore the options available, it is important to understand why free apps are so valuable for those who need to pay bills in installments. First of all, they offer a quick and practical solution for those who cannot afford to pay the full amount of a bill in one go. In addition, many of these apps have intuitive interfaces that make the process easier, even for those who are not familiar with digital financial services.

On the other hand, these tools are also useful for those seeking greater control over their finances. With features such as account management and installment suggestions, these apps help you better plan your payments and avoid excessive interest. So, regardless of your level of experience with financial technology, there is always something to explore.

RecargaPay: Simple and practical installments

O RecargaPay is a platform widely used in Brazil for installment payment of bills and other financial solutions. It allows you to split the amount of a bill into up to 12 installments, using credit cards or other payment methods. In addition, the app offers cashback and exclusive discounts for those who use its services regularly.

Another advantage of RecargaPay is its versatility. In addition to paying bills in installments, it also offers cell phone top-ups, bill payments and even online shopping. For those looking for convenience and savings, this is an excellent choice. Try it out and see how your finances can become more organized.

PicPay: Digital payment with installments

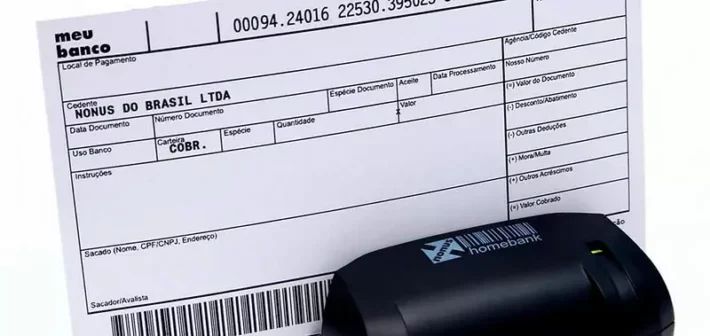

O PicPay is one of the Brazilian fintechs most popular and also offers the option of paying bills in installments. With it, you can scan the barcode on the bill and divide the amount into installments that can be paid on your credit card. In addition, PicPay offers a series of additional features, such as instant transfers and bill payments.

One of the great advantages of PicPay is its integration with social networks and digital services. This makes it easier to share payments and carry out quick transactions. For those looking for a modern and efficient solution for digital payment, this is an indispensable tool.

GerenciaNet: Complete solution for bills

O GerenciaNet is a platform aimed at small businesses, but it also offers incredible features for individuals who need to pay bills in installments. It allows you to manage your debts, negotiate payment terms and even create new bills with customized installment terms.

In addition, GerenciaNet offers detailed reports on your transactions, helping you keep your finances organized. For those looking for a complete solution for financial organization, this is a wise choice. Try it out and see how your accounts can become clearer and more controlled.

PagBank: Digital bank with installments

O PagBank, from PagSeguro, is a digital bank that offers several financial solutions, including installment payment of bills. With it, you can convert a single payment slip into affordable monthly installments, using your available balance or credit card. In addition, PagBank offers features such as a free digital account and a prepaid card with no annual fee.

Another positive point is the simplicity of the interface, which makes it easy to use even for beginners. financial technology. For those looking for practicality and low cost, this is an ideal tool. Try it out and discover how your finances can become more flexible.

C6 Bank: Debt renegotiation made easy

O C6 Bank is another digital bank that stands out in offering solutions for the installment payment of bills. It allows you to negotiate your debts directly through the app, transforming bills into affordable installments. In addition, C6 Bank offers a cashback program on purchases made with your credit card, helping you save even more.

An interesting feature of C6 Bank is its customer-centric approach. The app offers personalized service and tips for financial education, helping you make more informed decisions. For those looking for a complete and modern solution, this is a great choice.

Features that make these apps indispensable

Now that we know the main free apps for paying bills in installments, it is important to highlight the features that make them so special. First of all, they all offer features such as debt renegotiation, flexible installments and integration with credit cards or digital banks. These features ensure that you have full control over your finances, even in tight times.

Another crucial aspect is the ease of use of these tools. Even if you have no previous experience with digital financial services, you can navigate through intuitive menus and complete your transactions quickly. In addition, many of these apps offer detailed reports and payment suggestions, helping you organize your accounts efficiently. These details make these apps truly indispensable for anyone looking to improve their account management.

Conclusion

In short, the free apps for paying bills in installments are powerful tools that democratize access to modern and affordable financial solutions. They offer a multitude of features, from partnerships with Brazilian fintechs to integration with digital banks, ensuring that you find the best solution for your needs. So, don’t hesitate to try out the suggestions mentioned in this article and find out which one best suits your needs. After all, with so many options available, organizing your finances has never been so easy and convenient.